Experience swift execution, low-cost pricing models, and flexible leverage options when trading precious metals like gold and silver. Diversify your trading strategies by investing in these valuable assets, which are widely recognized as safe havens during market turmoil.

Real-time Gold Charts

Leverage up to 500:1

MT5 Platforms on desktop and mobile

Trade 24 hours a day, 5 days a week

Hedge risk & Expand your portfolio

Low cost trading

Diversify your portfolio

Metals trading refers to the buying and selling of precious metals, which are rare, naturally occurring metallic elements with high economic value. These metals serve both industrial and investment purposes. Industries use them for producing various products, including electronic components, jewelry, dental equipment, and catalytic converters, while investors collect coins and bars made of precious metals.

Investing in precious metals has made them the subjects of intense speculation in commodity markets. Traders view them as a form of currency that holds its value better than printed paper money. However, some skeptics argue that precious metals have limited utility beyond their industrial uses and are simply overpriced rocks. Ironically, the high premium placed on precious metals by traders makes them too expensive and impractical for most industrial applications.

How to trade Gold

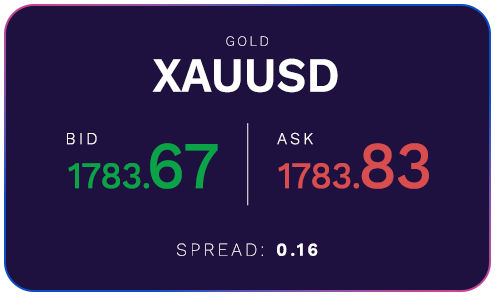

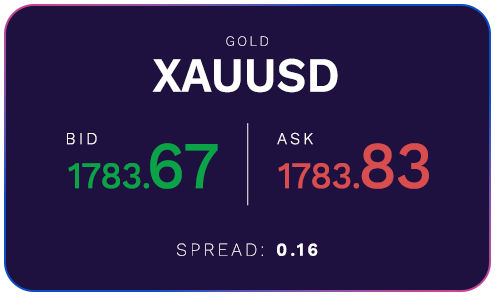

Gold trading using a contract for difference (CFD) is similar to forex trading, where traders buy or sell gold CFDs based on market price movements without owning the physical precious metal. XAUUSD is the symbol used for gold trading against the US dollar, and traders can sell or buy the “pair” when they predict a fall or rise in the gold price, respectively, just like with currency pairs.

For example, XAUUSD shows us that 1 ounce of Gold = $1895.24 USD.

Once you are prepared to trade, you have the option to take a long or short position. Going long indicates that you expect the value of gold to increase against the US dollar, while going short implies that you anticipate a decrease in its value.

The factors that influence precious metals include but are not limited to:

Like all products and services, the laws of supply and demand also apply to precious metals. A shortage, surge in need or interruption in production will result in an increase in metals prices. Conversely, faster extraction through technological improvement or other factors could saturate the market and diminish their value.

Market conditions including currency prices have a direct impact on metal prices. Precious metals are traditionally negatively correlated with the US dollar making them a useful hedging tool in times of economic instability. The same applies during political uncertainty and unexpected global events.

nything that dilutes the value of a currency results in an increase in precious metal prices. This is the case with quantitative easing (printing additional money) and higher rates of inflation. As metals are considered an alternate investment to the cash rate provided by financial institutions, their value generally decreases when interest rates rise.

The continual increase in industrial uses will have a positive impact on metal prices. Precious metals are being used in high performance applications such as electronics, energy and automotive related products. An increase of demand in these products and new applications will increase demand and precious metal prices.

Precious metals are a unique asset class as they have intrinsic value, provide protection against inflation and carry a safe-haven status. When utilised to diversify a portfolio, precious metals will reduce both volatility and risk.

Open a HedgeHood trading account today and join over a million others globally trading 2,000+ markets on an easy-to-use platform. Go long or short with competitive spreads on indices, shares, forex, gold, commodities, cryptocurrencies, bonds and more. Plus, get extended hours on major US shares, AI-powered tools and 24/5 client support. Learn more about trading CFDs with HedgeHood.

Metatrader 5 (MT5)

MT5 is the favourite choice for Metals traders around the globe. HedgeHood’ MT5 are packed with extras to ensure you’re equipped with all the tools you need to make better informed trading decisions. Tight Raw Pricing, fast execution and superior charts are the building blocks for our MT5 solutions.

Buying XAUUSD

Opening Price

$1,899.55 × 1 lot (100 ounces)= $189,955

Closing Price At $1902.05 × 1 lot = $190,205Gross Profit on Long Position $190,205 – $189,955 = $250

Closing Price At $1,897.05 × 1 lot = $189,705Gross Loss on Short Position $189,705 – $189,955 = -$250

Assuming the price of Gold against USD (XAUUSD) is $1,899.55, you opt to purchase 1 lot, resulting in a total value of $189,955 USD.

If you decide to sell 1 lot of XAUUSD at $1,902.05 two weeks later, you will have a total value of $190205 and a gross profit of $250. On the other hand, if the price of XAUUSD falls to $1,897.05, the total value of your trade will be $189705, resulting in a loss of $250.

Trade from 0.0 pips

| Standard account |

RAW Account |

||||

|---|---|---|---|---|---|

| Symbol | PRODUCT DESCRIPTION | MIN | AVG | MIN | AVG |

| XAUUSD | Gold vs Us Dollar | 0.16 | 0.21 | 0.02 | 0.07 |

| XAUAUD | Gold vs Australian Dollar | 0.21 | 0.72 | 0.11 | 0.62 |

| XAUEUR | Gold vs Euro | 0.14 | 0.45 | 0.27 | 0.19 |

| XAGUSD | Silver vs Us Dollar | 0.14 | 0.19 | 0.08 | 0.13 |

| XAGAUD | Silver vs Australian Dollar | 0.41 | 0.41 | 0.35 | 0.35 |

| XAGEUR | Silver vs Euro | 0.02 | 0.02 | 0.02 | 0.02 |

Open a HedgeHood trading account today and join over a million others globally trading 2,000+ markets on an easy-to-use platform. Go long or short with competitive spreads on indices, shares, forex, gold, commodities, cryptocurrencies, bonds and more. Plus, get extended hours on major US shares, AI-powered tools and 24/5 client support. Learn more about trading CFDs with HedgeHood.

Licensed & Trusted

Research & Education

Technical Analysis Tools

Transparent Pricing

One-stop Destination

24/5 Live Support

Forex Webinars

Trade On The Go

Same Day Account Opening

Our dedicated team of customer support agents are on hand 24/5 to provide you with multilingual support. Contact Us

Visit our comprehensive FAQ where you can find information about the services we offer and answers to your trading questions. Help Centre